It Works, If You Work It.

For our economy to provide a nice life for all we will need structural reform. How bad is it? This bad.

The American Pay Cut That Gave Us Obama and Trump, Twice

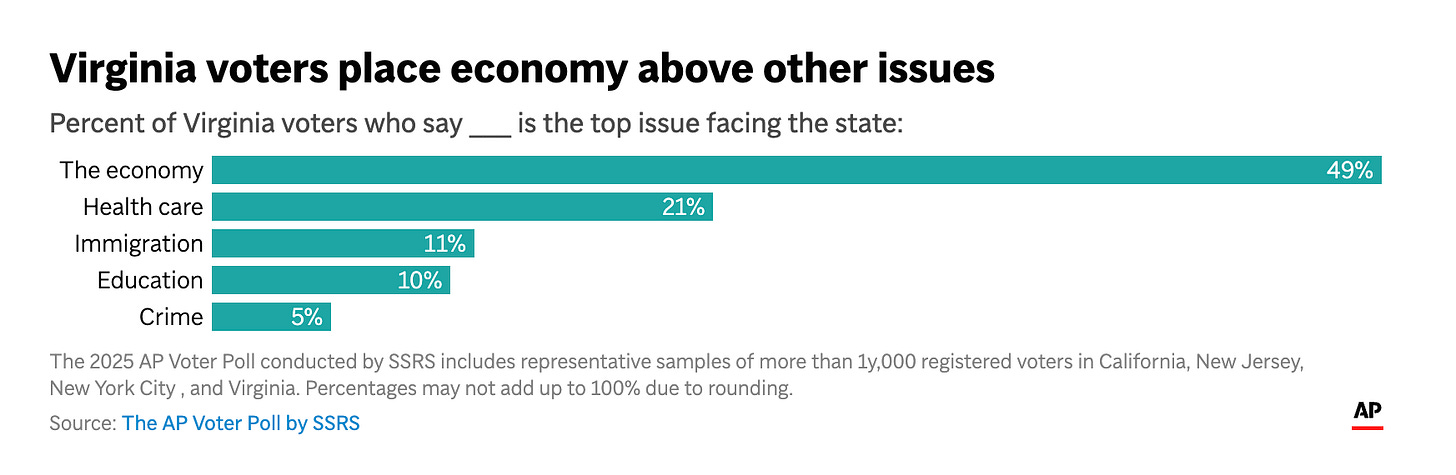

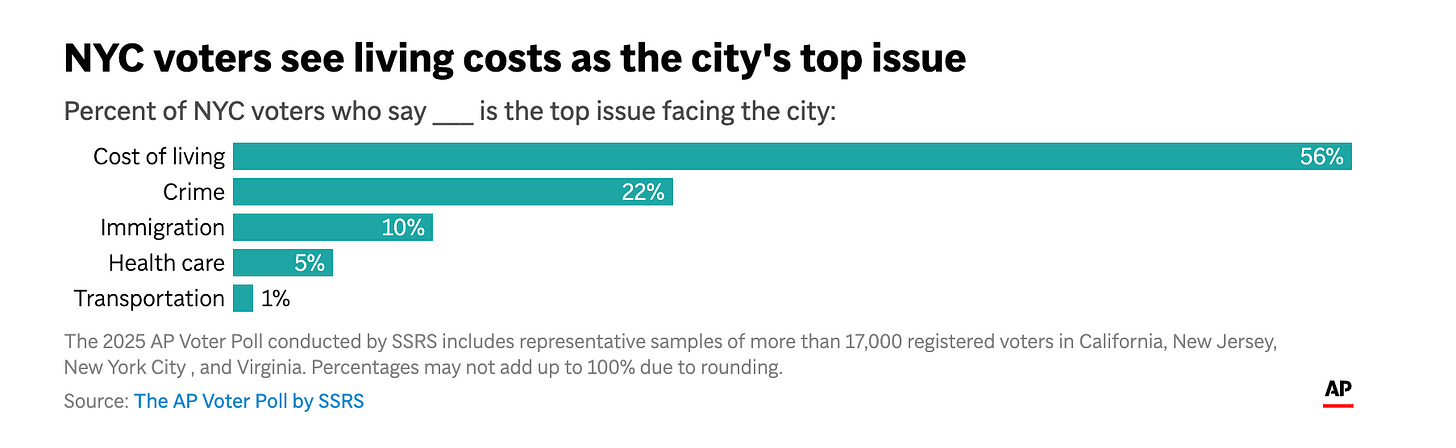

The elections earlier this month tell us where we’re headed. Democrats swept Virginia, New Jersey, and New York City. Exit polls showed 49% of Virginia voters put the economy as their top issue. In NYC, 56% said cost of living. New Jersey voters focused on taxes and the economy.

Trump owns the economy now. Voters just told him they’re still broke and they’re blaming him for it.

But here’s what matters more than any election. From Tennessee to New York, voters are asking the same question. Why can’t I afford to live well?

This is why Trump won twice. Why we elected Barack Hussein Obama promising hope and change, twice. Obama’s efforts were too little too late, and that led us to the Obama/Trump voters. We kept looking for hope and change in increasingly desperate places. Like an addict searching for our next fix, Americans are going to more and more dangerous places out of sheer desperation.

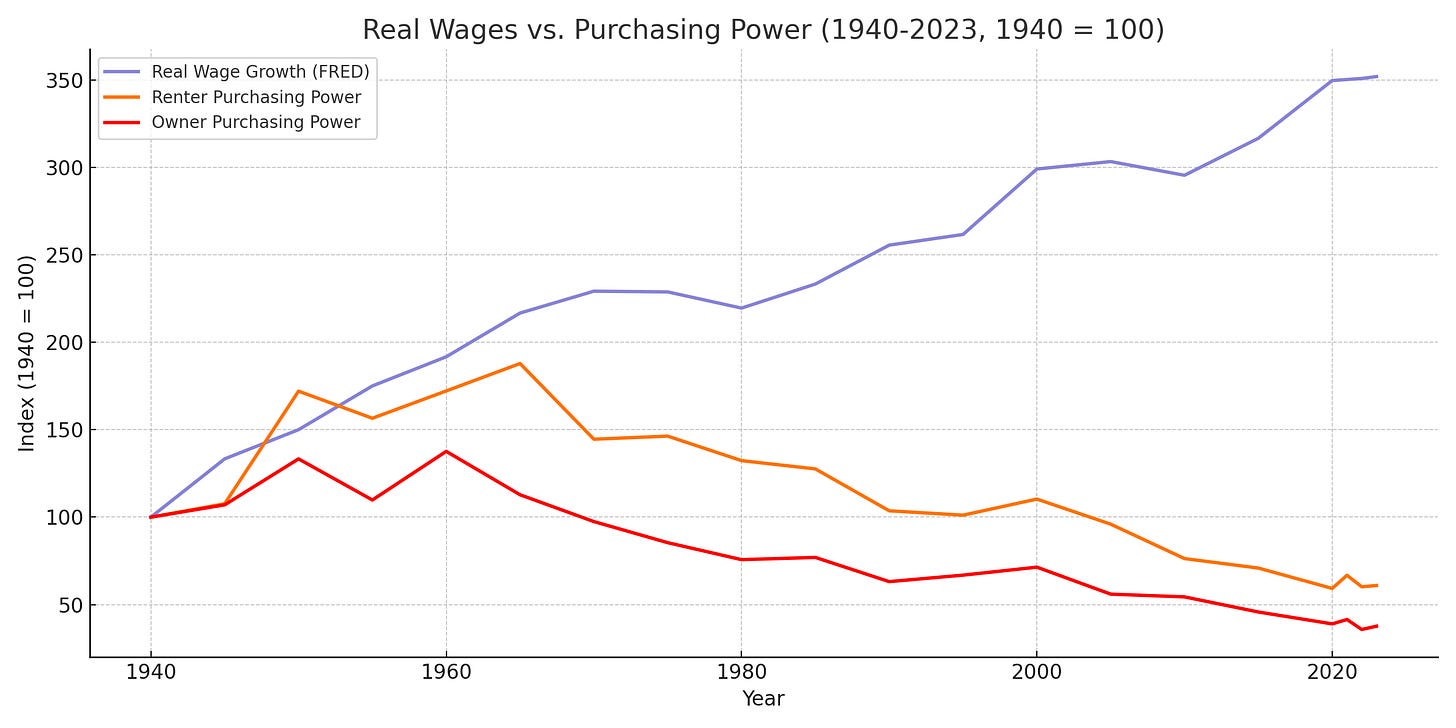

The reason is simple, and I can prove it with elementary school math. When experts claim today’s income can buy 252% more than our grandparents earned in 1950, and your life tells a different story, something’s wrong. By my math, we can’t buy 252% more of the essentials. We can afford 61% less.

Either basic math has ceased to function or the experts are missing something. The thing is reality tells us the answer. That’s why so many of us stopped trusting experts, economists, politicians, the media. That’s why we’ll listen to anyone willing to admit the decline is real rather than deny it exists.

Over the past two weeks, I showed you how Wall Street and the politicians rigged the economy and how the government hid it. Reagan legalized stock buybacks in 1982 and turned corporations into ATMs for executives. Wall Street privatized the technology we paid to invent. The Boskin Commission in 1995 embedded statistical tricks that make inflation disappear on paper while it crushes us in reality.

Now let me show you what it actually cost us. How does this impact our lives? Not in abstract economic terms. In the most concrete measurement there is. How much of our lives we have to trade just to survive.

They’re Stealing Our Time

In 1950, median INDIVIDUAL income was $1,971. A median home cost $7,354. The nation spent about $83 per person for healthcare. A four-year college degree cost $852.

Do the math. 3.73 years of work to buy a house. One week of work for healthcare. Less than two months for a college degree.

In 2023, median personal income was $42,220. A median home costs $429,000. Healthcare runs $14,570 per person per year. A four-year degree costs nearly $40,000.

10.16 years of work to buy a house. Twelve weeks of work for healthcare. More than ten months for college.

So wages went up 21x since 1950. Sounds great, right? But the essentials the core things we need to survive went up much much faster.

Housing went up 58x. Healthcare went up 175x. College went up 47x. But as I showed in “The Cover Up,” the official inflation numbers hide most of this through hedonic adjustments and statistical manipulation. The experts tell us the cost of life went up maybe 3-4x instead of 50-175x. Inflation is under control, economists and politicians tell us.

Our work is buying less of what we need to live, homes, cars, educations, childcare and healthcare. As a result we drown ourselves in debt as people and as a country. More and more Americans are putting food on credit cards. We saddle the nation with trillions subsidizing healthcare robber barons and student loansharks. The official statistics say inflation is tame. Our bank accounts know better. More and more of us are making the choice between medicine and food, between the car repair and the electric bill, between saving anything and just surviving.

We work our entire lives paying down debt instead of building wealth. Every extra year it takes to pay off a house is another year we don’t actually own anything. Every additional month making car payments is another month we are essentially renting transportation. Every decade paying off student loans is time we can’t save for retirement or invest or pass something down to our kids.

Our grandparents worked and owned things. We work and own debt.

And here’s the real kick in the teeth. In many states, even after you finally pay off that house you spent your whole working life to own, the healthcare system can take it. You get old, you need care, and Medicaid estate recovery takes the house to pay the bills. You work for 40 years to own something and the system strips it away at the end.

Wall Street and the executives who built this system aren’t just taking our money. They’re taking our lives and leaving us with nothing to show for it.

How I Measured It

I stripped away the statistical games. No hedonic adjustments. No theoretical rental equivalents. No basket reweighting. Just straight math. How much do we make and how much do the basics cost?

I looked at official government data. Median incomes from the IRS and Census Bureau. Actual prices for essentials from HUD and federal records. Then I asked one simple question. How many years, weeks, or months of work does it take to buy what we need?

I call this Years of Work. It’s the most honest economic measurement there is because you can’t manipulate it with formulas. A house costs what it costs. We earn what we earn. The math is elementary school level.

When my uncle graduated from high school, he took a job as a bag boy at the local A&P. Made enough for an apartment, food, going out, and a new Camaro. My aunt went to ETSU, worked part-time, and graduated debt-free while paying her own way.

One generation ago, working at a grocery store bought you independence. Working part-time paid for college. Try doing that today. You can’t. The math don’t math.

Think about how hard that makes it for generations to relate to one another. We live in different realities.

The Decline in Numbers

To measure the overall decline, I looked at what a median worker in 1950 could afford with their income. A house, healthcare, a car, college for their kids, food, utilities. The basics of a middle-class life. Then I calculated what income you’d need today to buy that same basket in the same amount of work-time.

Here’s what happened when you measure it honestly. You gotta ask yourself, which feels like what you’ve experienced?

The government claims real wages have increased 252% since 1950. My math says we’ve lost 61% of our purchasing power.

To match the essentials our grandparents could actually buy in 1950, 2023’s median income of $42,220 would need to be $102,024. Remember this is one person not a household or a family. ONE.

Two incomes today buy less of the essentials than one in 1950.

Either we’re losing buying power for the foundations of life or basic math is wrong. Many of our statistics have become completely detached from reality.

The Gap That Breeds Rage

This gap between what the statistics say and what we live breeds the rage you see in our politics.

You work harder than your parents and fall further behind. Your bank account shows it. The math shows it. But economists and politicians look at their statistics and see a functional system. A system going gangbusters. Everything is better than ok, it’s fucking GREAT! “Real” wages are up. GDP is growing. We just need a better message.

That’s not economic struggle. That’s dismissal. Being treated like you don’t understand what’s happening to your own life.

Two full-time workers today have less purchasing power than a single worker did in 1950. A middle-class life used to be achievable on one income. Now it takes two and even that isn’t enough. Every time both parents get forced to work instead of one having the choice to stay home, GDP rises. The government measures our desperation and calls it growth.

The chart below shows the official claims about what our annual income buys in Blue and what my math figures for renters and owners in orange and red.

The Debt Trap

As I showed in “How to Rig a Whole-Ass Economy,” Wall Street replaced wages with debt. When we couldn’t afford college, the financial industry gave us loans from Sallie Mae that we can’t discharge in bankruptcy. Can’t afford a house? Sign 30 years away to Wells Fargo. Can’t afford a car? Here’s an 84-month loan. Seven years of payments for a depreciating asset.

In 1950, household debt was $47 billion. Today it exceeds $17.1 trillion. When measured in years of work at median wages, the debt burden has grown from eight weeks of work in 1950 to 63 weeks today. A 670% increase.

What once took one year of labor now demands over three. This isn’t prosperity.

The Distraction

Here’s the trick. Economists and politicians point to the cheap TV. The smartphone. The streaming services. Look how much better life is. You have technology your grandparents couldn’t dream of.

Sure. Electronics got cheaper. I can buy a 55” TV for $300. My grandpa’s 19” black-and-white cost $200 in 1950. That’s equivalent to $2,400 today.

But while the TV got cheaper, everything that actually matters got more expensive. Housing is up 7x since 1980. The official stats say 3.7x. Healthcare is up 13x. Official stats hide 9.3x of that. College is up 12x. Official stats hide 8.3x. Food is up 5.7x. Official stats hide 2x.

As I detailed in “The Cover Up,” roughly 50-60% of actual inflation gets hidden through hedonic adjustments, Owner’s Equivalent Rent, and basket re-weighting.

We get cheap gadgets while the fundamentals get stolen. You can’t live in a flat-screen TV. You can’t raise kids on a smartphone. You can’t retire on streaming subscriptions.

The Political Consequences

Trump didn’t cause this disaster. He exploited it. He saw the anger, the despair, the realization that the American Dream had become a scam. He told people their pain was real. The system was rigged. Their leaders had failed them. And unlike the economists and media pundits, he never told them to learn to code.

That’s why he won in 2016, and again in 2024.

But look what happened this month. Democrats swept Virginia, New Jersey, and NYC. Voters sided with Democrats on the economy despite Republican advantages on crime and immigration. Independents swung hard left. Trump’s approval on the economy has cratered.

We’re still broke. Now we’re blaming him for it.

But Democrats haven’t seen the light yet either. Most of them don’t see the collapse because their numbers tell them everything’s fine. They’re incapable of fixing a crisis unless they can see it exists.

This is what happens when Reagan legalizes stock buybacks, when the Boskin Commission embeds statistical lies, when both parties tell people for forty years that they’re imagining their own decline. People stop trusting institutions. Not because we’re irrational. Because the institutions are lying.

What Any Real Solution Requires

Any politician promising affordability without a bold plan to shift power back to working people is full of shit.

Tweaking tax credits or adjusting interest rates ian’t going to restore affordability in any meaningful sense. We need to reverse a 50-year transfer of $79 trillion from the bottom 90% to the top 1%. We’re talking about breaking up monopolies and oligopolies that control our healthcare, our housing, our food. We’re talking about rebuilding unions strong enough to actually negotiate with capital. We’re talking about public ownership and public competition in captured markets.

That takes political power. Real political power. Not the kind you get from being polite or following Senate norms or designing another program with so many hoops nobody can use it. The kind you get from organizing millions of people who are tired of trading their lives for survival while Wall Street and the executives they enriched get richer.

We used to build things in this country. Real things that lifted everyone up. When we invested in ourselves, roads, dams, public universities, the research that created the internet, everybody got richer. Not just the people at the top.

We can do that again. But first we have to be honest about where we are.

These days GDP growth is disconnected from real tangible production. It is fueled by a parasitic elite taking more from us. Stock markets soar while families drown in debt. Official real wages rise on paper while buying power crashes in real life. We work harder than our parents did and fall further behind. More and more of us have insurance and still can’t afford to go to the doctor. We do everything right and still drown in debt.

The people who rigged this system are still telling us everything’s fine. The executives who legalized looting through stock buybacks. The economists who embedded the statistical lies. The politicians who protected the theft.

The Choice

We can keep measuring success by numbers designed to hide our decline. Or we can start building an economy that actually serves the people who make it work.

Right now we’re not just declining. We’re being stripped for parts. One week of our lives at a time. Ten years of labor for a house that used to take three. One decade of debt for an education that used to cost a part-time job.

The parasitic elite aren’t stealing our money. They’re stealing our time. Our lives. The years we’ll never get back.

No amount of statistical manipulation can hide that theft anymore. We see it now.

We need to start thinking about building what we need together, as a people. America is ready for systemic change. Hell, Trump has already done a lot of the destruction. The old order is weakened.

The question is are we ready to knock it over and build something beautiful in its place. Will “We The People” be at the table?

Corbin Trent

Absolutely nailed it. Official statistics v. lived experience. I asked just this question to a panel of four economists at the Levy Institute, congressional series seminar this week. Randy Wray's answer was best; ignore the statistics, people need jobs, pass a job guarantee; wall street has run amok, re-regulate it; the rich are too rich, so tax the hell out of them; need to rebuild manufacturing, make the Fed gear investment toward actually building real things. Now to build the political power to defeat the massive monied powers aligned against the people.

The tv our grandparents bought still works, too. The tv you bought 5 years ago is obsolete and the company made it stop working by no longer supporting it via required internet updates.