The 6 AM Vote That Proves the Point

The House just voted to take from people spending 177% of their income on survival, and give it to the richest among us. This is how the economy got rigged.

At 6 AM this Thursday morning, after an all-night session, House Republicans passed what they're calling the "big, beautiful bill" by a single vote: 215-214. Speaker Mike Johnson celebrated by declaring "it quite literally is morning in America."

But what actually passed in the dead of night tells a different story. The bill slashes taxes for the wealthy while cutting Medicaid, food assistance, and education. It adds trillions to the deficit while leaving 10 million Americans uninsured. According to the Congressional Budget Office, the bottom 10% will lose 2% of their income while the top 10% gain 4%.

In other words, they're taking money from people who spend 100% of their income on survival and giving it to people who turn money into more money.

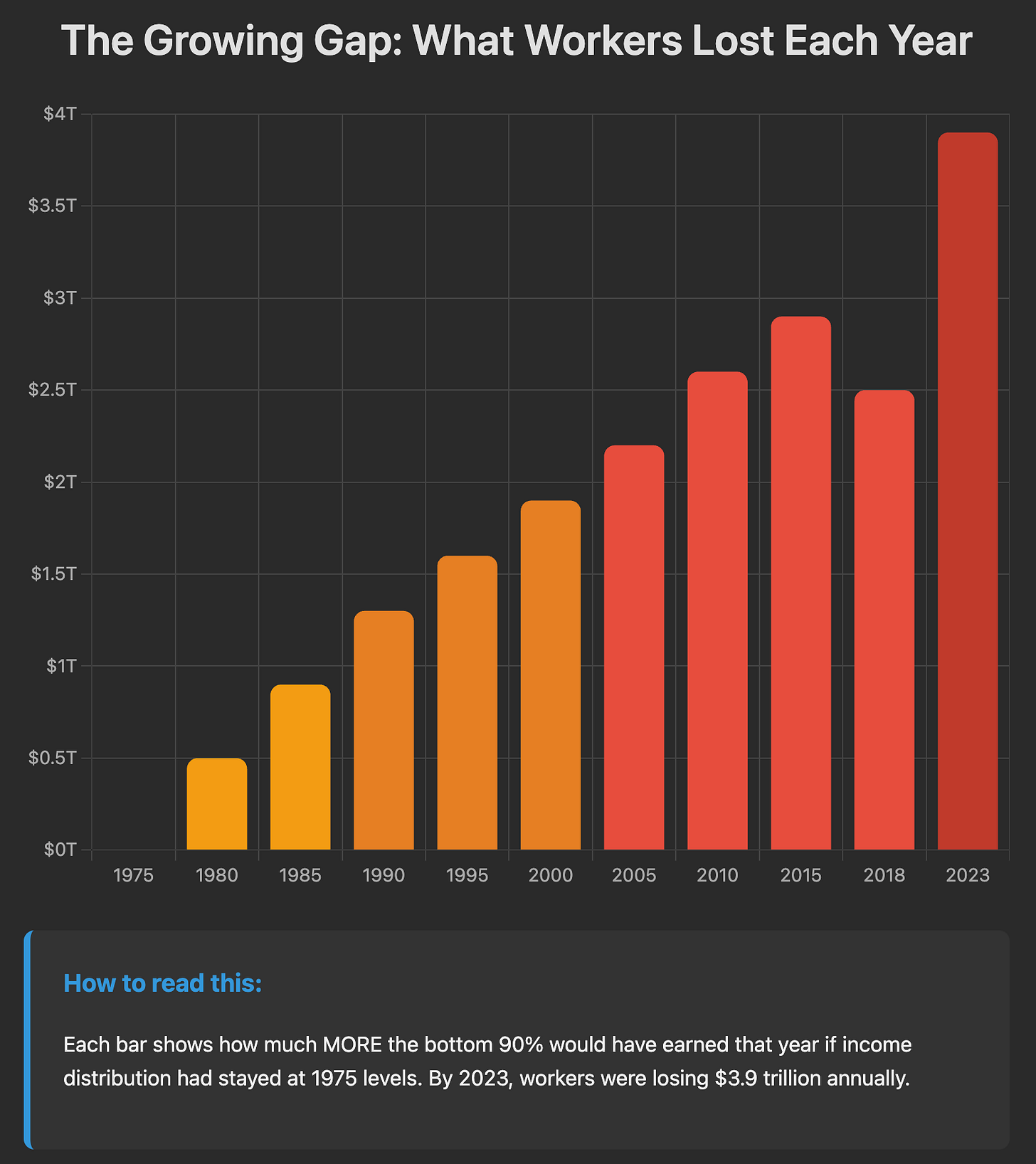

This vote isn't some political aberration. It's the system working exactly as it's been designed to work for the last 50 years. The same extraction machine that has been running since 1975 has just received a turbo boost. And if you're wondering how we got here, just listen to what the experts keep telling us.

Every month, the same voices hammer the same talking points. Noah Smith tweets that Bernie's a "gigantic liar" for saying super delegates influenced Democratic primaries. John Lettieri pushes charts showing "39 percent increase in purchasing power" and calls wage growth "solid, but not spectacular." Derek Thompson celebrates that "real wages have surged for the low-income" and posts unemployment charts to prove everything's fine.

Matthew Yglesias dismisses people's lived experiences entirely, arguing we shouldn't "trust people's self-assessment of comparisons to past economic eras they didn't experience personally over objective statistical data." I suppose he thinks we’re imagining our financial stress.

This isn't just a few thought leaders with bad takes. If you look at who these people follow and who follows them back, it's the same insular circle of Democratic operatives, think tank economists, and policy influencers, all reinforcing each other's delusions. Adam Ozimek from Moody's Analytics. Jeff Stein from the Washington Post. Derek Thompson from The Atlantic. They're all in each other's follower lists, all pushing the same "actually, things are great" narrative while working families drown in debt.

Every jobs report, every economic briefing, every time someone complains about costs - out come the same charts, the same talking points, the same insistence that the numbers prove you're wrong about your own life.

Our policies are designed for extraction, not for building. And Thursday morning's vote was the system working exactly as designed.

How the Extraction Works

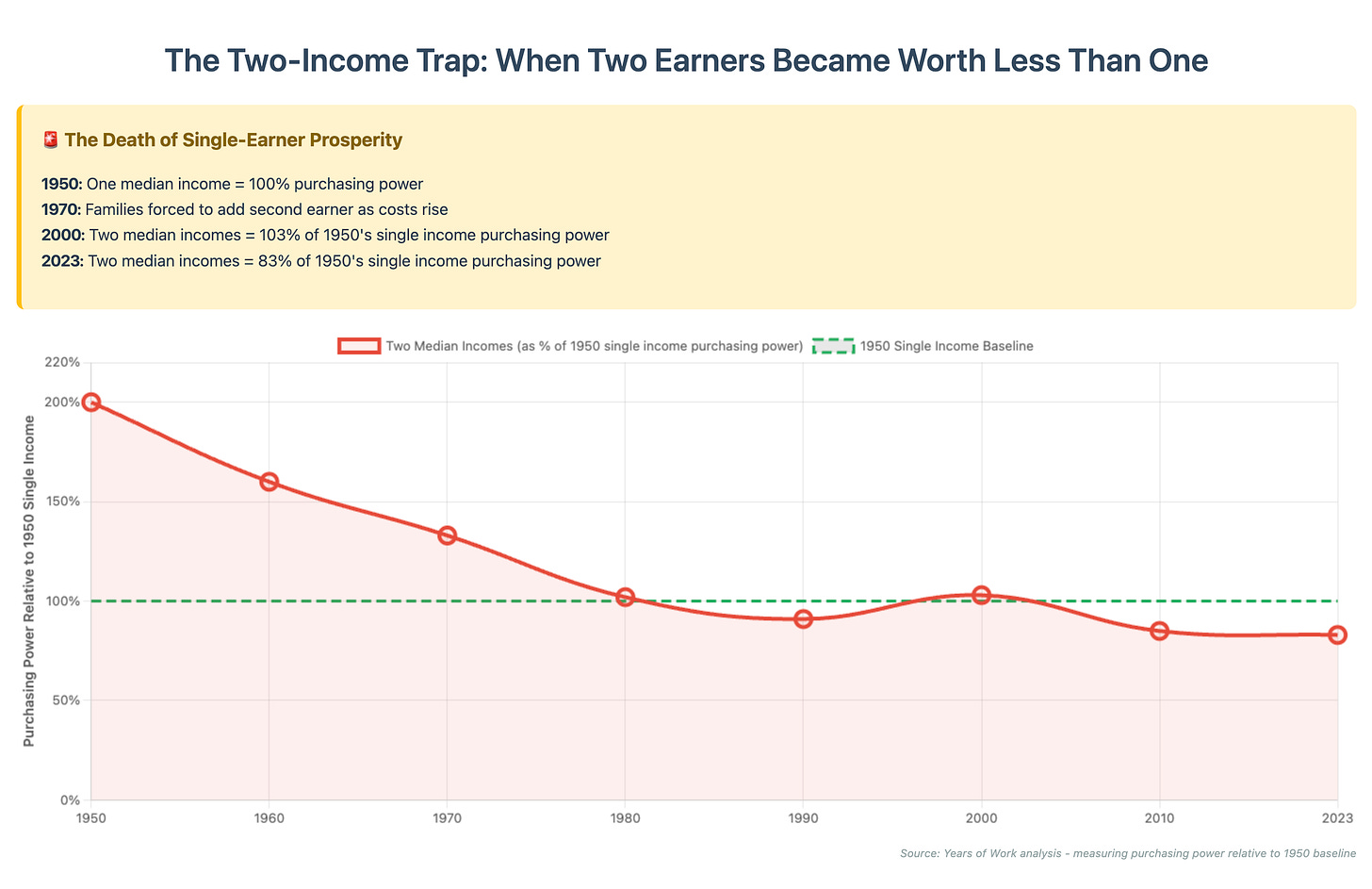

You want to know how they're lying to you? They keep showing charts that prove household spending on housing has been "stable" at around 30% of income since the 1980s. What is rarely mentioned is that those numbers steady held steady because more families sent a second person to work.

In 1950, one worker could afford a middle-class life. Now it takes two full-time workers to afford what one could buy back then - and it's still not enough.

I want to make sure you get this point. We're comparing individual income collapse to household spending explosion. In 1950, households had one earner. By 2023, they had 1.9. So when we look at household spending data, we're looking at what TWO incomes can buy versus ONE from before.

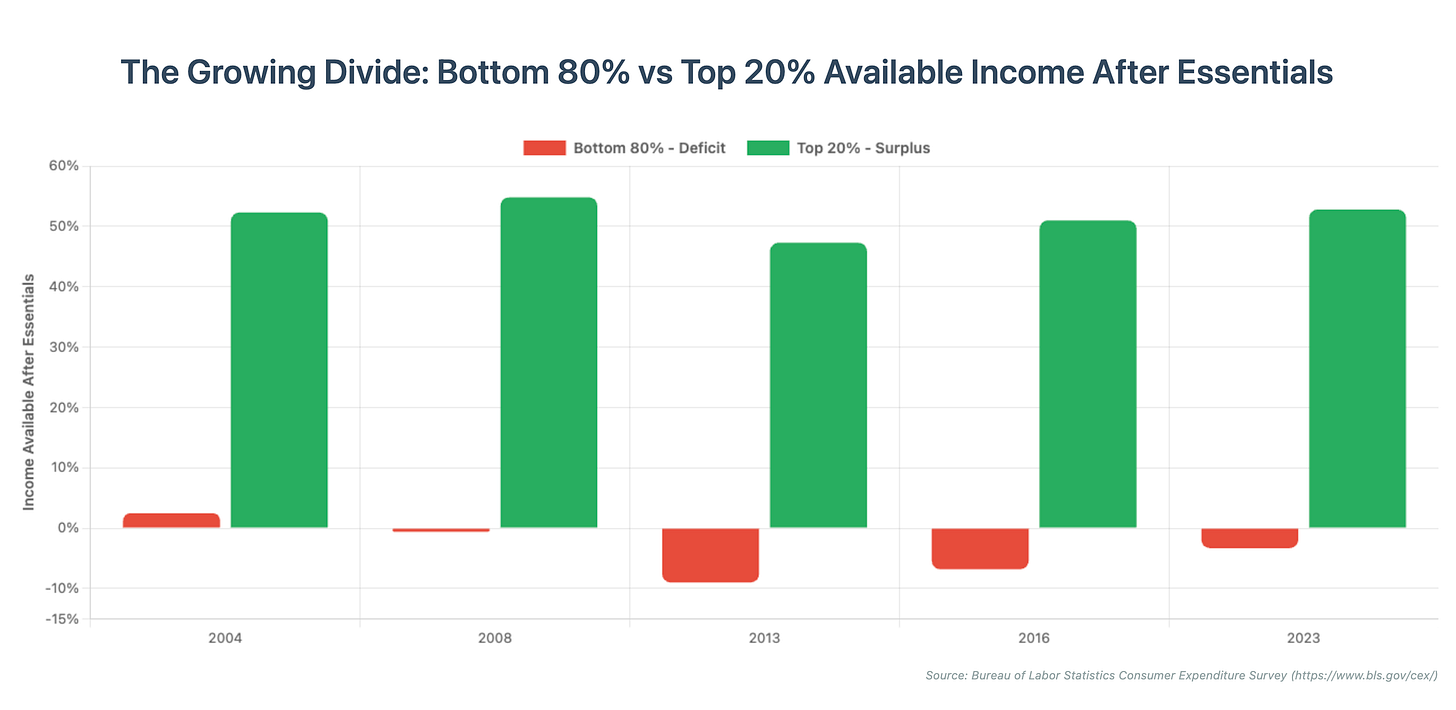

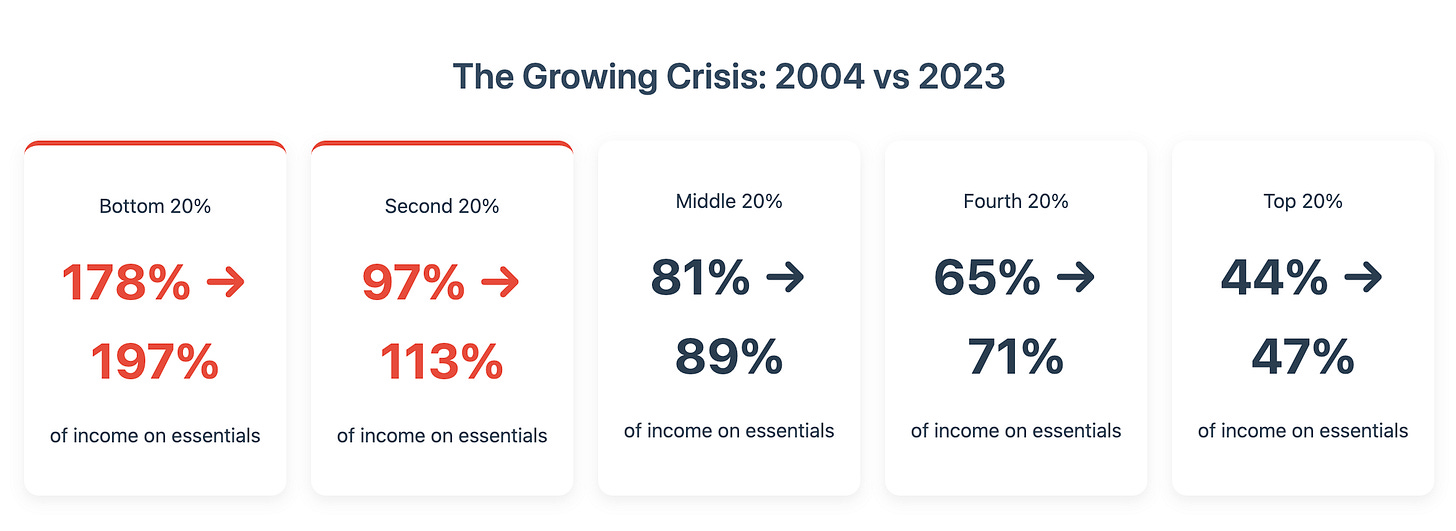

The average household in the bottom 80% now spends more than 100% of their combined incomes just on essentials. The bottom 20%? They're spending nearly 200% of their total household income on basics. That's with everyone working. What am I calling the essentials? Food, housing, education, transportation, and healthcare. I didn’t even include childcare and clothing.

"But wait," you're thinking, "how the hell can someone spend 200% of their income?" Simple. We're subsidizing it through Medicaid, SNAP benefits, housing vouchers, and insurance subsidies. This is what they mean when you hear that we are subsidizing Walmart's business model - a company that pays workers so little they need government assistance to survive. So we foot the bill and Walmart can keep their labor costs down and their profits up.

Those "stable" housing costs? Built on the backs of women entering the workforce not only by choice, but by necessity. Built on hours of commuting because you can't afford to live near your job. Built on many people giving up on homeownership entirely and splitting apartments with strangers well into their 40s. Built on the lie that two incomes would mean twice the prosperity, when it really meant half the buying power for each of you.

Meanwhile, the BLS and its cheerleaders keep telling us inflation isn't really happening. "Don't worry," they say, while admitting that housing, healthcare, education, and childcare have all outpaced wage growth by massive margins. But here's the kicker - those things they admit are "a little expensive"? They make up 100% of the income for the bottom 80% of Americans. ALL OF IT. Hell, they make up nearly 50% of the spending for the top 20%, again without clothing and childcare.

So I reckon that wages aren't stagnating; they are collapsing. If you need two full-time workers today to afford what one could buy in 1950, that can’t be economic growth. I mean that is a catastrophic decline. When 20% of our households are spending nearly 200% of their incomes on the basics, you ought not argue that we have a healthy economy. (yet they persisted)

Here's what that looks like in real life: To have the same purchasing power as a 1950 median earner, you'd need to make $102,024 today. The actual median income? $42,220. That's a 59% collapse. It means choosing between fixing your car and filling prescriptions. It means your kid skipping breakfast so there's enough for dinner. It means working two jobs and still coming up short on rent.

And here's the really sick part: our Years of Work analysis shows exactly how this happened. Housing went from requiring 3 years of median income in 1950 to over 10 years today. College went from a few months of work to over a year. Healthcare went from a week or two of wages to months of income. These aren't small changes - these are the foundations of middle-class life being ripped away and sold back to us at prices we can't afford.

But Noah Smith and John Lettieri and the whole Democratic Party economics establishment keep telling us we're imagining it. Keep showing us charts that "prove" everything's fine while the bottom 80% of the country drowns in debt just trying to survive.

Car loans used to be 12-month affairs. You saved up, put down a big chunk, and paid it off fast. Then they stretched them to 24 months. Then 36. Then 60. Now the average car loan is 72 months, with some lenders offering 96-month loans - 8 years to pay for a depreciating asset. They didn't make cars more affordable. They made debt more affordable. And then they convinced you it was the same thing.

Same trick with housing. In the 1940s, mortgages required 50% down and came with balloon payments. After the Depression, we got 20-year mortgages with 20% down. Then the GI Bill brought us 30-year mortgages with no down payment required. Then that became a norm, with down payments dropping from 20% to 3% and sometimes 0%. Don't be shocked if you start hearing about making 40- and 50-year mortgages more available.

Each time they stretched the terms, they claimed they were making homes and cars more "accessible." However, what they really did was make debt more expensive and increase prices. The monthly payment might be manageable, but you're paying for 30 years instead of 15, and the house costs twice as much to begin with.

But stretching loan terms only works so long. Eventually, you run out of road. So they found another way to extract: administrative bloat. They couldn't make the loans any longer, so they made the institutions more expensive.

Higher education tells the same story. Between 1976 and 2018, full-time administrators grew by 164%. Other professional staff grew by 452%. Teaching faculty grew by just 92%. Student enrollment? Just 78%. At top-tier schools, there are now three times as many non-faculty staff members as faculty members.

In some cases, there are more staff than students. These people aren't teaching. They're not researching. They're managing compliance, marketing, student life, diversity initiatives, development, alumni relations, strategic planning, and about 50 other things that didn't exist when college was affordable.

Healthcare is worse. Administrative roles exploded by 3,800% since the 1970s while physicians grew by just 200%. Administration now consumes 30% of total healthcare spending in the U.S., compared to under 5% in countries like Japan, Switzerland, and Germany. We don't have a healthcare system - we have a billing system with some medicine attached.

As a result of all this, the working class lives in permanent financial emergency while the rich compound returns on assets ony they can afford to buy. And the whole time, people like Matthew Yglesias tell them they're imagining their poverty.

Think about how a casino works. The house doesn't win every hand. But the games are structured so that over time, money flows from players to the house. The longer you play, the more you lose. And the house uses your losses to build bigger casinos.

That's our economy now. The $79 trillion RAND identified as transferred from the bottom 90% to the top 10% since 1975? That's 79 trillion dollars of teachers' salaries, mechanics' wages, nurses' overtime - all of it sucked upward and transformed into stock buybacks, private jets, and fourth homes. GDP growth looks impressive, but it's mostly just chips moving around the table. Asset prices soar, but they're disconnected from productive value. We mistake financial activity for wealth creation.

So what is to be done? Build baby, build.

Anytime we've fixed major problems or taken huge leaps as a society, it's been done by the government. Not subsidizing private companies. Not regulating them more nicely. Building the shit ourselves. The Interstate Highway System. Rural electrification. NASA. The internet. We built them, and private industry had to compete or get out of the way.

We can't wait for a presidential candidate to inspire Democrats to go in a different direction. We can't wait for Hakeem Jeffries to suddenly believe that there's a different America out there worth building and saving. As I wrote before, if Congress had zero women or zero Black members, we'd call it a crisis of representation. But when it's missing half the workforce—the folks without degrees, without connections, without safety nets—we act like that's just how government works.

We need leaders to emerge, and emerge quickly. Leaders who've fixed their own cars, who've chosen between medicine and rent, who understand that complexity isn't sophistication—it's gatekeeping. We're losing too much ground while too many people keep advising us to stay the course or moderate.

If you're reading this and you know someone still parroting the "real wages are up" line, send this to them. Or tag them. Let's have this conversation where everyone can see it.

The question isn't whether we can afford action. The question is how much longer can we afford inaction?

"It quite literally is mourning in America."

"Morning in America" sends chills down my spine. It's a Reagan quote. Disarmingly folksy Reagan was the worst president for the working class. His administration was the beginning of our end. If I had my way, I'd remove his name from all those airports, etc. that the cultish Republicans stuck it on to honor him. The only president less deserving of such an honor is Trump.